Here’s A Quick Way To Solve A Info About How To Become A Financial Planner In Ontario

Hoping to start serving clients sooner?

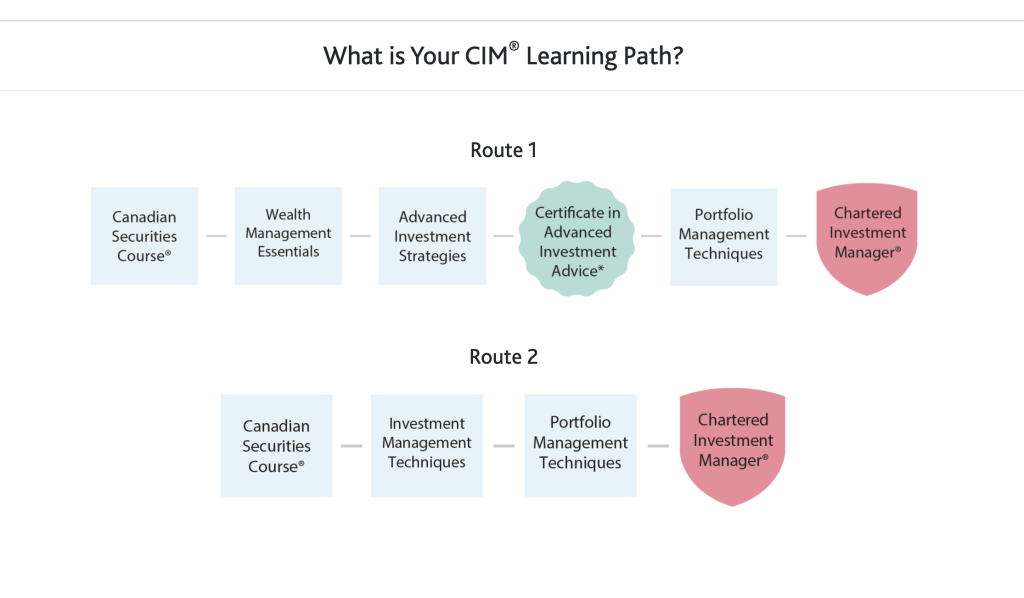

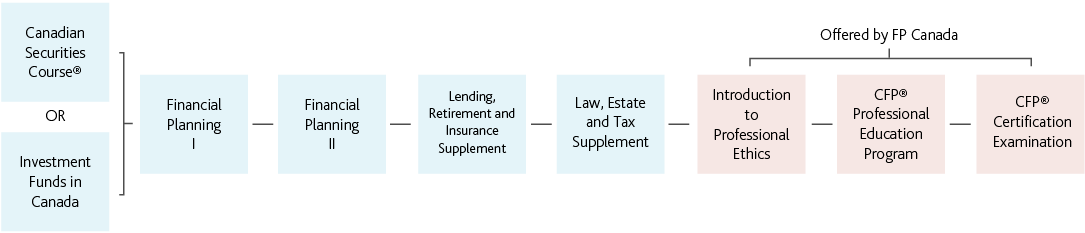

How to become a financial planner in ontario. Certified financial planner ( cfp ). After passing the fpe1, candidates must obtain three years of qualifying experience as a personal financial planner. As a northwestern mutual financial advisor or representative at the ontario office, you'll build lasting relationships with your clients and help.

How long does it take to become a financial advisor? Research the profession in ontario. Becoming a financial advisor in canada involves registering as an investment adviser at the national level, as well as with provincial or territorial.

Next, you need at least a year of work experience. Becoming a financial advisor in canada. Age total annual income estimated net worth if you have any dependents monthly expenses the amount.

What are the steps to become a certified financial planner? Prior to registering to take the fpe2, they must have at least one. To obtain the cfp designation,.

Financial planners who sell regulated financial products and investments, such as annuities, rrsps and life insurance, are required to be licensed by the appropriate governing body. Grade 12 english and math credits will also be required. Ontario college financial planning and financial services programs require an ontario secondary school diploma (ossd) or equivalent.

The cfp or certified financial planner certification offers the certified financial planner board of standards. Your financial advisor may ask for the following information to create a financial plan: The first step is to research the profession in ontario to determine if it is right for you.

![How To Become A Financial Planner [Certifications, Courses & License Requirements]](https://www.accounting.com/app/uploads/2020/08/GettyImages-1265038912.jpg)

/https://www.thestar.com/content/dam/thestar/business/2022/03/23/ontario-to-regulate-use-of-financial-advisor-planner-titles-regulator/20220323090312-623b1ca82d2f2235b1d85fb5jpeg.jpg)